LTC Price Prediction: Technical Breakout and ETF Catalysts Signal Bullish Outlook

#LTC

- Technical Breakout Potential - LTC trading above 20-day MA with converging MACD suggests building bullish momentum

- ETF Catalyst Development - SEC approvals and new ETF filings create institutional demand drivers

- Macro Environment Support - Fed rate cuts and regulatory clarity providing favorable market conditions

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

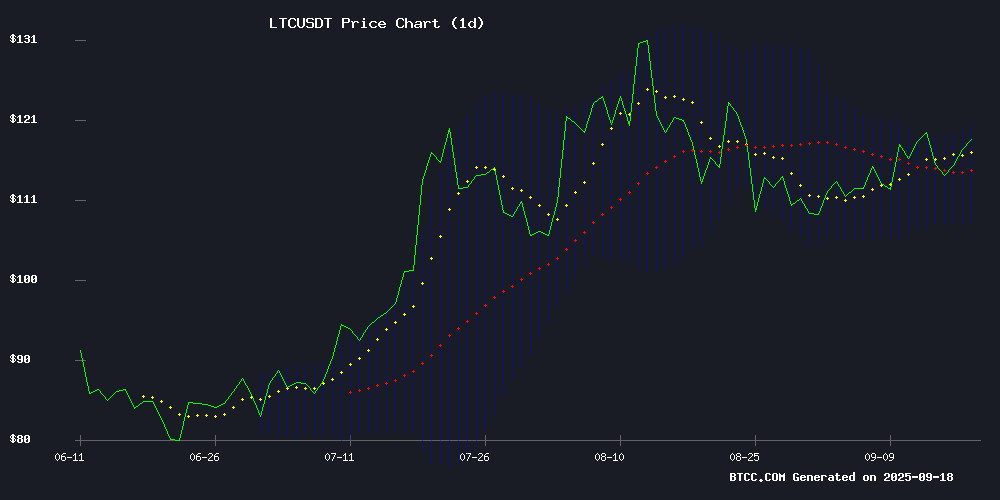

Litecoin is currently trading at $117.58, positioned above its 20-day moving average of $113.86, indicating underlying strength in the current market structure. The MACD reading of -2.56 remains in negative territory but shows improving momentum with the histogram at -1.99. Price action is hovering NEAR the upper Bollinger Band at $119.80, suggesting potential resistance ahead while finding support at the middle band level.

According to BTCC financial analyst Robert, 'LTC's position above the 20-day MA combined with its approach to the upper Bollinger Band creates a technically constructive setup. The MACD, while negative, shows signs of convergence that could support further upside movement if buying pressure continues.'

Market Sentiment: ETF Approvals and Institutional Adoption Fuel LTC Optimism

The cryptocurrency market is experiencing a significant shift in sentiment driven by regulatory developments and institutional adoption. Recent SEC approvals for crypto ETF listing standards, combined with specific LTC ETF speculation and Tuttle Capital's filing for Litecoin-targeted ETFs, create a favorable backdrop for price appreciation.

BTCC financial analyst Robert notes, 'The convergence of regulatory clarity through ETF approvals and growing institutional interest in altcoins like Litecoin provides fundamental support for the current technical bullish setup. The Fed's rate cut environment further enhances the risk-on sentiment benefiting digital assets.'

Factors Influencing LTC's Price

Top ‘Qualified’ Altcoins To Stack Before The ETF Season Kicks In

The crypto market is entering a transformative phase as U.S. regulators greenlight new standards for exchange-traded funds (ETFs). A select group of altcoins—now eligible for ETF listings—could redefine investor strategies in the coming months.

The SEC's approval of the Grayscale Digital Large Cap Fund, which includes Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA), marks a pivotal shift. Simultaneously, generic listing standards for ETFs have been cleared across major exchanges like NASDAQ, NYSE, and CBOE. This streamlines the approval process, reducing delays from months to weeks.

Analyst Dan identifies twelve cryptocurrencies meeting the SEC’s threshold, all with six months of futures trading on CFTC-regulated markets: Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM), Avalanche (AVAX), Shiba Inu (SHIB), Polkadot (DOT), Solana (SOL), and Cardano (ADA). Cardano barely qualifies, having recently crossed the six-month milestone.

The altcoin market cap, excluding Bitcoin, shows signs of breaking out after a prolonged consolidation. Institutional interest in these qualified assets is expected to surge as ETF season approaches.

SEC Approves New Standards to Fast-Track Spot Crypto ETFs Listings

The U.S. Securities and Exchange Commission has greenlit a regulatory framework that could accelerate the launch of spot cryptocurrency exchange-traded funds. By adopting Rule 6c-11, the agency eliminates case-by-case reviews, potentially reducing approval timelines from months to weeks.

Major exchanges including Nasdaq, NYSE Arca, and Cboe BZX filed documents outlining the streamlined process. "This decision removes artificial barriers to digital asset products while maintaining investor protections," said SEC Chairman Paul S. Atkins. The move comes as the agency faces impending deadlines for Solana, XRP, and other altcoin ETF applications.

Bloomberg Intelligence analyst James Seyffart hailed the development as a watershed moment: "The crypto ETP framework we've been waiting for is finally here." Market observers anticipate a flood of new investment products tracking Bitcoin, Ethereum, and other major cryptocurrencies in Q4 2025.

U.S. SEC Approves Generic Listing Standards for Crypto ETFs, Altcoin Market Rebounds

The U.S. Securities and Exchange Commission has greenlit generic listing standards for commodity-based exchange-traded products, including spot crypto ETFs. The move streamlines the approval process, bypassing the traditional lengthy review under Section 19(b) of the Securities Exchange Act of 1934.

To qualify, crypto assets must trade on an Intermarket Surveillance Group member market and have futures contracts listed on a CFTC-regulated exchange for at least six months. Analysts predict a surge in spot crypto ETF launches, with Bloomberg's Eric Balchunas forecasting over 100 new listings within a year.

Coinbase Global Inc. currently lists futures for 12-15 crypto assets, positioning tokens like Dogecoin, Solana, and Cardano for potential ETF inclusion. The altcoin market has already shown signs of recovery following the announcement.

PACT SWAP Expands Cross-Chain Trading with Dogecoin and Polygon Integration

PACT SWAP, a bridgeless cross-chain decentralized exchange, has added support for Dogecoin (DOGE) and Polygon (POL), bringing its total supported networks to seven. The platform now enables native swaps across Bitcoin, Ethereum, BNB Chain, Litecoin, TRON, Dogecoin, and Polygon without relying on wrapped assets or bridges.

Stephen Morris, CEO of PACT SWAP Labs, emphasized the project's mission to rival centralized exchanges in pair breadth and pricing while maintaining decentralization. Sandeep Nailwal, Co-Founder of Polygon, highlighted the significance of cross-chain liquidity for mainstream adoption, noting PACT SWAP's role in reducing user complexity and risk.

LTC ETF Speculation and SOL Adoption Growth Amid BullZilla Presale Surge

Market volatility persists as meme coins fluctuate wildly, shifting investor focus toward structured presale opportunities. Solana and Litecoin demonstrate resilience, with SOL climbing 1.09% to $236.32 following payroll platform integrations, while LTC gains 1.55% to $115.25 ahead of potential ETF developments.

BullZilla's $BZIL presale emerges as a standout, entering Stage 3 with a 1,043% early ROI. The project's Roarblood Vault referral system and tiered pricing model—currently at $0.00006574—have secured $460,000 from 1,600 holders. Each $100,000 milestone triggers automatic price appreciation, creating urgency among participants.

Crypto Markets Eye Upside As Fed Delivers First Rate Cut

The U.S. Federal Reserve has cut its benchmark interest rate by 25 basis points to a range of 4%-4.25%, marking the first reduction since December 2022. This dovish pivot signals growing concerns about economic headwinds from trade tensions and potential unemployment risks.

Fed officials projected two additional cuts this year, potentially lowering rates to 3.5%-3.75% by December. The decision passed with an 11-1 vote, revealing internal divisions as political pressure mounts. President Trump has demanded more aggressive easing while criticizing the central bank's approach.

Crypto markets typically benefit from looser monetary policy as investors seek alternative stores of value. Bitcoin and major altcoins may see increased institutional interest as yield-seeking capital flows into risk assets.

Banco Santander Launches Retail Crypto Trading via Openbank in Germany

Banco Santander has entered the digital asset space by introducing retail cryptocurrency trading through its online banking platform, Openbank. German customers can now trade Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Polygon (MATIC), and Cardano (ADA). The service, which charges a 1.49% transaction fee, will soon expand to Spain and include additional tokens.

This move positions Santander as one of the first major European banks to offer such services, aligning with the EU's Markets in Crypto-Assets regulation. Carlos Carriedo, CEO of Openbank, emphasized that crypto integration strengthens the platform's appeal to tech-savvy investors.

Hashj Contracts Offer Short-Term Profit Opportunities in Bitcoin, Solana, and Litecoin Markets

The cryptocurrency market continues to evolve at a rapid pace, with major digital assets like Bitcoin (BTC), Solana (SOL), and Litecoin (LTC) setting the tone for investor engagement. While these established tokens trade at elevated levels, Hashj emerges as an innovative platform for mining profitability without traditional infrastructure burdens.

Hashj's cloud-based model eliminates hardware ownership, technical maintenance, and exorbitant energy costs associated with conventional mining. The platform handles all operational complexities while users simply rent computing power to generate returns. This approach lowers barriers to entry for retail participants while offering seasoned traders an alternative to direct futures speculation on top cryptocurrencies.

New users can capitalize on promotional incentives including $118 signup bonuses, positioning Hashj as a potential disruptor in the crypto investment landscape. The platform's focus on accessibility and cost efficiency mirrors broader industry trends toward democratizing digital asset exposure.

LTCCloudMining Touts $5,000 Daily Profit Potential Amid Bitcoin's Bull Market

As Bitcoin stabilizes near $110,000, cloud mining platform LTCCloudMining is capitalizing on renewed interest in cryptocurrency mining. The company promotes its low-barrier entry model as a solution to traditional mining's hardware and technical challenges.

"Our 'full holdings' strategy aligns with the growing institutional recognition of crypto as a reserve asset," said CEO KAMAND, referencing Trump-era policies. The firm positions mining as a hedge during market volatility, urging investors to accumulate BTC reserves.

Cryptocurrency Market at Inflection Point as Altcoins Face Return Constraints

Quantitative analysis reveals structural limitations in mature cryptocurrency protocols, with established altcoins like Litecoin (LTC) and Polkadot (DOT) facing valuation ceilings that constrain explosive growth potential. While institutional interest grows—evidenced by Grayscale's HBAR ETF filing—mathematical models suggest diminishing returns for assets trading at elevated valuations.

Polkadot's technical performance exemplifies this trend, oscillating between $3.90 support and $4.02 resistance despite ecosystem developments. In contrast, emerging projects like LAYER Brett's $0.0058 presale present asymmetric return profiles, attracting capital seeking higher beta opportunities.

Tuttle Capital Files for SEC Approval on New Crypto ETFs Targeting Bonk, Sui, and Litecoin

Tuttle Capital has submitted an application to the U.S. Securities and Exchange Commission seeking approval for three new cryptocurrency exchange-traded funds. The proposed ETFs would track Bonk, Sui, and Litecoin, employing a put credit spread strategy using FLEX options to manage volatility while generating income.

The Bonk Income Blast ETF represents institutional recognition of the Solana-based memecoin's growing market presence. With a $1.87 billion market capitalization and $348 million daily trading volume, Bonk has emerged as the second-largest memecoin behind Pudgy Penguins. The filing comes as the SEC continues to delay decisions on spot ETF applications for altcoins.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The cryptocurrency is trading above its key 20-day moving average with bullish momentum indicators, while fundamental catalysts including ETF approvals and institutional adoption provide strong support.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $117.58 | Above 20-day MA |

| 20-day MA | $113.86 | Support Level |

| MACD | -2.56 | Converging Bullishly |

| Bollinger Upper | $119.80 | Near-term Resistance |

| Market Sentiment | Positive | ETF Catalysts |

The combination of technical strength and positive fundamental developments suggests LTC could experience further upside potential, particularly as the ETF season approaches and institutional interest grows.